Despite the criticism of its ratings system, the Nielsen Company does one thing very well. They measure quite accurately the number of people watching television live on a traditional set. In the early years of the television industry, the task Nielsen set out to accomplish was to provide a reliable way to estimate numbers of viewers at any given time for any show. Their methodology proved so accurate that it became, and still is, the standard for the entire television industry. If their methods and system are so accurate, why isn’t the company pushing harder to include viewing numbers from newer technology platforms — online, streaming or downloads?

The Business Model Disconnect

Television broadcasting as an industry has two distinct sides. There is the business side — the corporations who own the different networks and production companies, who are the ones making executive decisions over such areas as finances and programming. The other side is the creative — those crafting the show: producers, writers, actors, directors, crew. Now, there are also two types of networks in existence, broadcast and cable. The rise of cable uprooted broadcast antennas as the main delivery system for television service to the majority of US households. With cable, viewers discovered a whole new variety of channels. Even in the early days of cable, most markets went from around 4-8 choices in television networks to at least 50-100 choices. Many of those networks were independent, striving to reach and serve an audience interested in a particular subject.

For example, let’s look at the geek world’s favorite “whipping boy” network, Syfy. The one we love to hate but can’t bring ourselves to completely stop watching. When the network first appeared on our cable systems, it was known as the Sci-Fi Channel. Geeks rejoiced. Finally, a network that was just for us. An entire network dedicated to the broadcast of science fiction and fantasy programming. At first, shows were syndicated reruns of classic shows. With the move of Stargate: SG-1 from Showtime to Sci-Fi after five seasons, the era of original programming began. The audience loved most of what was offered, even the goofy Sci-Fi Original Movies. Come on, we’ve all watched a few of those. Whether it’s to see one of our favorite actors, the disbelief that the new one can’t be worse than the others, or just to make fun of them, we do watch. Then, a few years ago, something changed. The beloved Sci-Fi Channel turned into the barely tolerable SyFy. The network gained a reputation among its core audience for being too quick to pull the plug on quality shows and filling their roster with cheap reality-style programs in an effort to appeal to the coveted mainstream adult viewer. Many of the changes occurred after NBC Universal purchased the cable network.

The large broadcast conglomerations noticed how lucrative the cable channels could be, and they all wanted a piece of the cable pie profits. In recent years, most of the cable networks that were independent have been bought up by large entertainment conglomerations. However, the powers at each one still work hard on the public relations side to keep fans convinced it’s the same network they’ve watched and loved. Now, the only competitive cable network that is not owned by a corporate giant is AMC. AMC Networks has some of the top-rated and most critically acclaimed original programming of any cable network and the corporate hawks would like to snatch that prey.

Here’s a rundown of a few of the companies that own the networks known for science fiction or fantasy programming. CBS and Warner Brothers jointly own the CW. Warner Brothers also owns TNT and the Canadian-based Space. Disney owns all ABC affiliated properties. News Corporation is the parent of all Fox networks. In 2011, General Electric, owner of NBC Universal, sold all the NBC properties to cable monster, Comcast. Comcast is now the owner of NBC Universal and, therefore, the Syfy network. The company also owns stakes in a slew of networks including A&E, History, and online provider Hulu. A good listing of the corporations that own broadcast and cable networks can be found here.

Although cable has brought a variety of networks to viewers, behind the scenes the entire industry is run by the same movers and shakers that have controlled the business end of broadcast for decades. The technology and the ways we can watch television programs are changing rapidly, but the mindsets of those setting the business model are stuck in a passing era. Part of that mindset includes finding an impartial method that levels the playing field to compete for the all-important advertising dollars. Enter the Nielsen ratings. The advertisers love it. The broadcast corporations love it. Everyone agrees to the same system. In the industry’s opinion, it’s like comparing apples to apples.

The five broadcast networks are dependent on advertising revenues to pay for the production of a series. Basic cable is a little less dependent on those dollars. They do get fees from subscriptions. Yet, since most of those networks are owned by the same companies as the broadcast channels, they run on the same principle. Premium cable channels, like HBO and Showtime, are subscriber-based and not dependent on money from advertisers. It’s an interesting point that many critically acclaimed and honored shows in the past few seasons have come from those sources, like Game of Thrones and Boardwalk Empire. But at the end of the day, both broadcast and basic cable shows live and die by the ratings, so those are the ones I will concentrate on.

Time for one of those dirty little secrets: Views equal money.

The owners of the networks want big numbers of views for a show because it affects what rates they can charge to advertisers. But they don’t really care about the viewers of any particular show, other than the all-important 18-49 breakdowns.

The Technology Disconnect

DVRs have been in existence for less than a decade, but have become the primary way busy people watch their favorite shows. The Nielsen Company has instituted categories to represent that sort of time-shifted viewing to a degree.

Live views now have the category of Live+Same Day. If a viewer has DVRed a program, but watches it before 3 a.m. Local time, it will count as a live view. Nielsen meters are programmed to send their data to the company at that time. However, there is a dirty secret here: If the viewer pauses the show for more than 25 seconds, it’s kicked out of the Live viewing category.

Nielsen provides an adjusted number for all programs. It’s called Live+7. This category measures DVR views of a show within seven days of the live airing.

Introduced in 2007, the C3 rating is actually the most important to the industry. It measures the “views” of commercials within and book-ending a program up to three days after the live airing. This number is not often published to the public, but the numbers are often consistent with the Live+Same Day ratings. That is why the Live number is always the number quoted for a given show’s ratings.

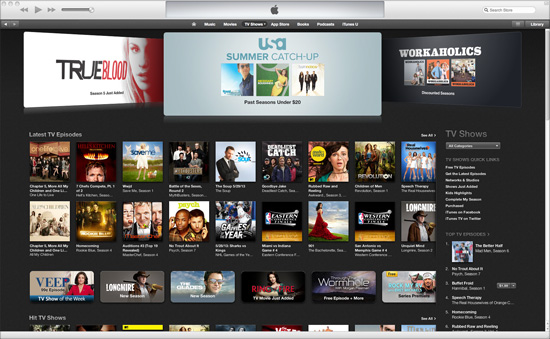

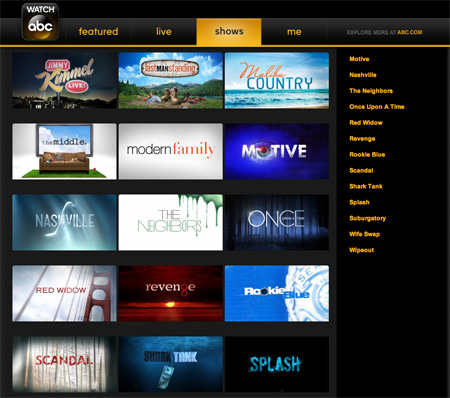

DVRs and, before them, VCRs, are not liked by advertisers. The belief exists in the industry that one of the reasons a viewer employs time-shifted viewing is so they can skip through the commercials. Because of the attitude of the advertising industry, broadcasters are not quick to embrace the new technology, either. Even more recent than DVR usage, entire episodes of a series are now available to watch online through services like Netflix, Hulu and even the networks’ websites. iTunes and Amazon offer paid downloads of programs.

Those of us who consider ourselves geeks or nerds are among the first to openly embrace new technology. One of the things we use technology for is to make our entertainment, especially television viewing, fit into our lives at our convenience. One of our major criticisms of the Nielsen ratings is the exclusion of time-shifted, downloaded, or streamed viewing, which is how most of us watch television.

Here’s another of those dirty little secrets: The Nielsen Company doesn’t measure online ratings because the people with the money don’t care about online views. The numbers for online views are direct views while the method for measuring traditional television viewing is based on sampling.

The Disconnect with Direct Views vs. Sampling

Advertisers are convinced those who DVR are commercial-skippers. When a show airs online, it is shown without commercials or with different commercials than the live airing. The advertisers who are relying on the Nielsen ratings have no interest in online viewers. What they are interested in is the breakdown of the sample audience. The numbers for online Nielsen ratings do not measure the popularity of a show. The purpose of the ratings is to measure an approximate number of people in a certain group watching the commercials of a particular show so broadcasters can know how high advertising rates for that show can be set.

In the television industry, it’s about who pays for it, not who watches.

Revenue from traditional television viewing currently outpaces revenue from online viewing by a wide margin, close to a 1 to 10 ratio. If we use $1 to represent online revenue and $10 to represent traditional viewing, to produce the same amount of revenue a show would need 10 million online views to 1 million traditional television views. Until that margin narrows, most advertisers are going to cling to the current model. It works for them.

In the long run, cable networks don’t need a show to get as many views as a broadcast network. It’s the reason a “hit” on a cable network can have from 2-6+ million viewers and get a renewal. Even on cable, a show must still pay for itself through a combination of fees and advertising. One of the phrases industry insiders tend to toss around is the “magic number” of viewers. There is no exact magic number that will automatically get a show renewed. The number for every show is different because it depends on the profit margin the network wishes to receive. Over seasons, a production’s cost can rise exponentially — salary raises, rises in production costs, and studio space, to name a few. Those numbers can cut into the profit margin to a degree where the network considers the show no longer sustainable financially in relation to its rating. The reason cited for cancellation will be “low ratings”, even if the ratings equal or or experience a marginal drop compared to previous seasons.

This season, Syfy renewed newcomer Defiance, which has been averaging slightly over 2 million viewers. The network’s history of renewing shows is consistent with those numbers of viewers. The Walking Dead Season 3 finale on AMC drew the highest number of viewers for any cable network drama and won the night even over broadcast offerings, with a total view of 12.4 million and 8.1 million in the 18-49 category.

Next Time

In December 2012, the Nielsen Company announced a joint venture with Twitter to create the “Nielsen Twitter TV Rating”, designed to assign a rating that measures how much a television show is being talked about on Twitter. Nielsen acquired Social Guide and spent a year conducting a study on the correlation between television ratings and television programs mentioned on Twitter. The study found a “statistically significant” correlation. It sounds rather corny, but can Twitter volume impact TV ratings or a network’s decision about renewals or cancellations?

If I talk about a show on Twitter, but my family and I aren’t a Nielsen family, how can we have an impact on ratings? Even though the Nielsen ratings are the bar for setting advertising rates, networks consider other factors in the decision to renew or cancel. We’re all aware of low-rated shows that got renewals (Fringe, Chuck) and solid-rated shows that were cancelled (Stargate: Atlantis, Terra Nova).

Is it possible to do anything to save my favorite show?

In the previous article, I used a favorite show of mine that has been on the bubble this year, Warehouse 13. Recently, Syfy announced it was renewing the show for a final, but shortened, Season 5. Some fans are happy to get a bit more, and some are disappointed it’s not a full season. It’s my opinion that TPTB at Syfy had targeted the show for cancellation, but changed their minds due to specific feedback over the past few weeks that proved the show’s solid viewership. But that’s a story for next time.